Disruptive. Futuristic. Decentralised. These words were commonly used to describe virtual assets as the products first emerged. Lately, a new wave of adjectives became prevalent-Volatile. Risky. Unsecure. A series of adverse events that occurred during 2021-2023 resulted in the merits of the virtual assets sector being called into question. In response, several jurisdictions globally resorted to taking stringent actions (including law suits) against virtual assets businesses. At the same time, some progressive jurisdictions, with their futuristic vision and belief in the promise offered by the virtual assets sector, successfully created a conducive environment for the sector through their enabling legal frameworks.

Among these progressive jurisdictions, the UAE has emerged as a global pioneer, being one of the first countries globally to introduce suitable business licenses and regulations for virtual assets service providers (VASPs). In 2018, the UAE launched the Emirates Blockchain Strategy 2021 which sought to capitalise on the Blockchain technology to transform 50 per cent of Government transactions onto the Blockchain platform. In the same year, the Abu Dhabi Global Market (a financial free zone in the UAE) implemented a comprehensive and bespoke regulatory framework for VASPs.

Over the years, the UAE has witnessed several crucial regulatory developments in the virtual assets space. In particular, establishment of the Dubai Virtual Assets Regulatory Authority (VARA), recognised as the world’s first regulator to exclusively focus on virtual assets, has catapulted the UAE into a global hub for VASPs. The collaborative approach adopted by regulators and their years of experience in regulating VASPs have enabled the UAE to develop a clear, comprehensive and transparent regulatory environment for VASPs. Owing to such regulatory certainty, numerous leading global players have since established their global/ regional headquarters in the UAE and obtained licenses to offer their products and services in a legally compliant manner.

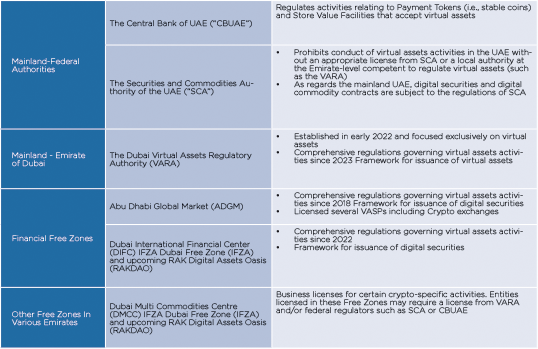

There are multiple avenues within UAE for VASPs to establish their businesses and obtain suitable licenses. Amongst others, virtual assets focused broker-dealers, fund/asset managers, advisory firms, custodians and Crypto exchanges are regulated and require a license in the UAE. Overall, the regulations stipulate various conduct of business obligations relating to technology governance and controls, investor protection, safe custody of client assets, AML and CFT safeguards and integrity of market for virtual assets.

Recognising that navigating the bespoke regulations can be a daunting exercise, KARM has recently authored a report titled ‘Virtual Asset Regulatory Framework | An Evolving Landscape’, which analyses the regulatory framework of the UAE, Bahrain, the UK, the US, Liechtenstein and Switzerland, for VASPs.

The report provides an overview of the general regulatory framework while touching upon suitable jurisdictions within the UAE for VASPs, types of businesses regulated and key licensing requirements. A snapshot of the regulatory positions is provided in the table below:

The way forward for VASPs:

The UAE regulators continue to actively engage with virtual assets businesses and the regulations continue to undergo advancements to cater to the ever-evolving needs of the sector. For example,

ADGM is currently in the process of evaluating a regulatory framework for Distributed Ledger Technology Foundations. On the other hand, CBUAE has made substantial headway with the CBDC project.

It is increasingly evident that the UAE virtual assets sector is poised for growth and innovation.