A utility token encapsulates a unit of value generated in a Decentralised economy, universally recognisable and enforceable by a system. The circulation of economic value is denoted by the native token and its accompanying utilities. As the economy’s demand rises, so does the demand for the token that signifies it, increasing its value. There are about 23,000 cryptocurrencies held in approx 400mn wallets. Like any open market traded asset, the price of a token is determined by its underlying value, so a good token design aligns the value accrual in the system to the value accrual to the token.

Like any corporation or country, delivering value to users or stakeholders should always be the priority. Otherwise, the token’s price will end up in a descending loop. Like a messy cap table inflicts mortal wounds on a startup or poor monetary policy can derail a nation’s economy, lousy token design can doom a Decentralised economy.

Terra collapsed primarily due to its economic model of Luna and UST. Billions of Dollars were swiped from the market over a few weeks due to the uncontrolled reward model of games like Axie Infinity.

So what is the best way to do it? With over 8 years of experience, the TDeFi team has developed a profound understanding of token dynamics and has helped over 100 projects with token engineering.

TL;DR

We follow a three-step approach to designing the economics of any cryptographic token.

- Engineering token utility

- Design Unit economics and projected cash flow statement for 5 years

- Map each unit of value with the token

- Calculate allocation size and vesting term for every stakeholder contributing to the economy.

Engineering Token Utility

The utility of a token imparts an organic demand, which drives increased value and liquidity in a market. Notionally, demand represents the number of users wanting to buy the token, and the utility can drive this. Thus, an element of utility is the most crucial element.

For example, by offering incentives to engage, paying for the services offered by the protocol, and having a loyal and engaging community, a project might see increased demand for its native token.

- We at TDeFi follow a four-step framework to identify the points to create demand.

- List all the prospective token holders like Investors, Vendors, customers, community, team, advisors, treasury etc.

- Corresponding to each holder, list the use cases, and reasons for holders to buy the token.

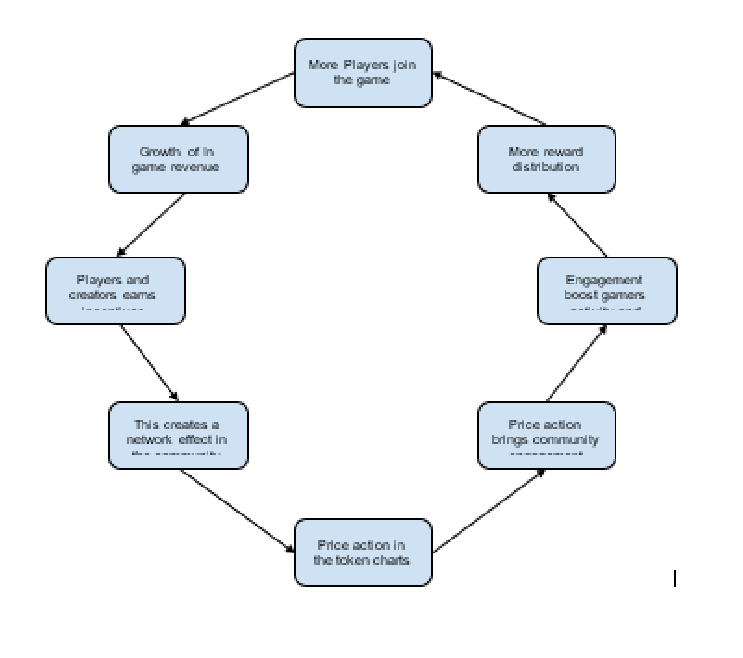

- Draw a self-sustainable token value accrual cycle.

- Incentivisation to bring Network effect

A typical value accrual cycle for a Web3 game looks like

Unit Economics: Pillar of any Sustainable Economy

Unit economics are the financials associated with the cost and earn of a unit of something in your business. Cost to make a unit of your product, cost to attain a customer, what you earn per customer, etc.

Typically, token businesses ignore Unit economics’s importance when designing their token economy. But nothing could be further from the truth that unless Unit economics makes sense, it’s rare to find a profitable business model with unsustainable unit economics.

For example, as per gaming activity, an average gamer spends $76 per month on a game, but many Web3 games ignored this and built a reward emission that made these gamers earn more than they could spend. Such burning unit economics failed the business, which led to a catastrophic impact on the token price.

Supply and Demand: Two Sides of the Token Equation

To understand how the price of a token is likely to fluctuate and whether its value will decrease due to inflation, there are a few crucial questions to consider when examining the supply side of the equation. These include assessing the supply dynamics and analysing the impact of token allocations, vesting periods, and emissions on token economics.

The projections of users, revenue and costs can determine allocations. The size of allocations can be determined based on the token’s use case. The vesting period refers to the period where the sale of a token is restricted after initial distribution and is commonly also called the lockup period. Vesting is estimated based on the product roadmap since it directly influences the buy and sells pressure in the open markets.

Few essential things to consider while creating pool allocations

- Centralisation Risk: A large portion of supply shouldn’t be controlled by the team or related entities like Reserves etc.

- Governance Rewards: Decentralization empowers better governance through DAO structures. Hence, DAO rewards should have proper allocations considering the governance required in the protocol operations.

- Token release through Smart Contracts: All the token pools should have a smart contract for their release (time-based or event-based). Few cases have been observed where the team decided to change the token vesting at their discretion, which isn’t a good practice.

- Deflationary/Inflationary Economy: Similar to share buybacks, the token model can also create a burning mechanism that reduces the circulating supply imparting higher value to the remaining ones. Whereas an inflationary token will continuously be minted over time, with no capped limit. However, one common issue we have observed in many token models is that the burning activity doesn’t happen through a smart contract and instead stays under the discretion of the founder/team. This isn’t a good practice and should be discouraged.

- Dual Token Models: In the duel-token model, two distinct tokens are used on a single Blockchain to create a better economic structure. Many projects in this model opt to have one token function as a store of value, generating a secondary utility token to fuel actions on the Blockchain network. Prima facie, this model appears to separate financial incentive from utility; however, the dual token model complicates the value accrual mechanism in the long run.

TDeFi: Incubating and Building Sustainable Tokenomics Models

TDeFi is a Web3 Incubator and consulting company that provides access to mentors, token economics, industry connections, and growth-hacking partnerships. It seeks projects looking to survive, thrive for years, and disrupt the status quo.

As a token incubator, our team of analysts will support you in designing growth-oriented token economics and shaping up token utilities. To achieve this, TDeFi works with its incubated companies to identify the key stakeholders in their Ecosystem and develop a token distribution model that rewards stakeholders for their contribution. Through preliminary examination, we first identify a viable virtuous cycle for the native token of the platform. Then we formulate the incentivising model to create a self-sustainable economy with necessary governance structures.

As a partner of the Crypto Oasis Ecosystem, we’ll happily help the companies with their token designs.